Purchasing a home is one of the most significant investments you'll make in your lifetime. Whether you’re a first-time buyer or looking to upgrade, the process can be both exciting and daunting. To help you navigate this journey, we've compiled a list of essential home buying tips, including some personal advice from our Vice President of Lending, to ensure you find the perfect home and make a smart financial decision.

Looking for a home? Check out our Home Buying Center

In need of insurance? Click below to see our Energy Capital Insurance options

Determine Your Budget

Understanding your budget is the first and most crucial step in the home buying process. Knowing how much you can afford will help you narrow down your options and prevent future financial strain.

- Evaluate Your Finances: Assess your income, savings, and expenses to determine how much you can allocate toward a home purchase. Consider using online mortgage calculators to estimate monthly payments and how different interest rates might affect your budget.

- Get Pre-Approved for a Mortgage: Pre-approval gives you a clear idea of your borrowing capacity and shows sellers that you’re a serious buyer. It can also speed up the closing process once you find a home.

Knowledge is power when it comes to home buying. Familiarize yourself with the local real estate market to understand property values and trends.

- Study Recent Sales: Look at recent sales in your desired area to get an idea of what homes are selling for and how quickly they are being bought.

- Monitor Market Trends: Pay attention to market trends such as average time on the market, price fluctuations, and inventory levels. This information can help you make more informed decisions about when and where to buy.

Choose the Right Time to Buy

Timing can significantly impact your home buying experience and the price you pay. While summer is traditionally the most common home buying time, shopping during off-peak seasons can offer unique advantages.

- Personal Tip from Our VP of Lending: "Summer is traditionally the most common home buying time, as families look to move between school years. Shopping in off-peak times, such as late fall and early winter, could give you an advantage for those looking to get out of their current homes. If you are willing to move when it’s a bit chillier out, you could get more house for your money."

Identify Your Needs and Wants

Knowing what you need and want in a home will help you stay focused and make the best choice.

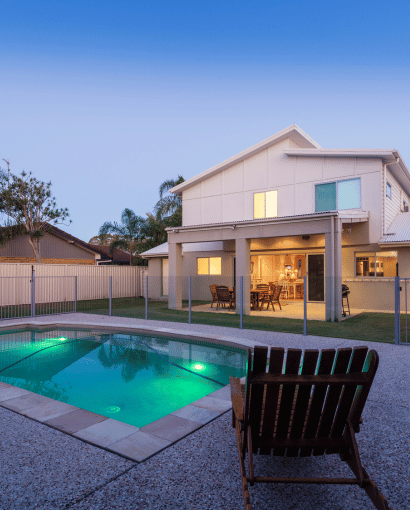

- Make a List: Create a list of must-have features (e.g., number of bedrooms, location) and nice-to-have features (e.g., a pool, a large backyard). This will help you prioritize and avoid getting swayed by properties that don’t meet your essential criteria.

- Consider Future Needs: Think about your long-term plans and how your needs might change in the future. This can help ensure your new home remains suitable for years to come.

Work with a Real Estate Agent

A knowledgeable real estate agent can be an invaluable resource throughout the home buying process.

- Find a Reputable Agent: Look for an agent with good reviews and a strong track record in the area you’re interested in. Personal recommendations from friends and family can also be helpful.

- Leverage Their Expertise: A good agent will provide insights into the market, help you find homes that meet your criteria, negotiate on your behalf, and guide you through the closing process.

Be Prepared for Additional Costs

The purchase price isn’t the only cost you need to consider when buying a home. Be prepared for additional expenses that come with home ownership.

- Closing Costs: These can include fees for appraisals, title searches, and legal services. They typically range from 2% to 5% of the purchase price.

- Maintenance and Repairs: Factor in the cost of ongoing maintenance and any immediate repairs needed after purchase. Setting aside a budget for these expenses can prevent financial surprises.

Conduct Thorough Inspections

Never underestimate the importance of a thorough home inspection. It can reveal potential issues that could affect the value and safety of your new home.

- Hire a Professional Inspector: Ensure the inspector is licensed and has good reviews. They should examine the property’s structure, electrical systems, plumbing, roof, and more.

- Attend the Inspection: If possible, attend the inspection to ask questions and get a firsthand look at any potential issues. The inspector can provide valuable insights and explain the significance of their findings.

Make a Competitive Offer

When you find the right home, making a competitive offer is crucial, especially in a seller’s market.

- Consult with Your Agent: Your real estate agent can help you determine a fair offer based on comparable properties and current market conditions.

- Be Flexible with Terms: Offering flexibility with the closing date or other terms can make your offer more attractive to sellers, even if your offer isn’t the highest.

The home buying process can take time, and it’s essential to remain patient and positive throughout.

- Don’t Rush: Take your time to find the right home. It’s better to wait for the perfect fit than to rush into a decision you might regret.

- Stay Positive: There may be setbacks along the way, such as losing out on a bid or facing financing challenges. Keep a positive attitude and stay focused on your goal.