Ways To Consolidate

Move your high-interest card balances to ECCU and save with 0% APR* for the first 12 months (variable rates apply after the intro period).

Quick, flexible loans to simplify multiple bills into one. Perfect for seasonal expenses, credit cards, or unexpected costs.

What Debt Consolidation Can Do for You

Debt consolidation can help you:

-

Clear up holiday expenses before they add up

-

Combine credit card debt into one manageable payment

-

Pay down student loans faster

-

Recover from summer spending

-

Free up your budget for what matters most

Try our Debt Consolidation Calculator and see how much you could save!

Debt Consolidation Calculator

Debt Consolidation FAQ

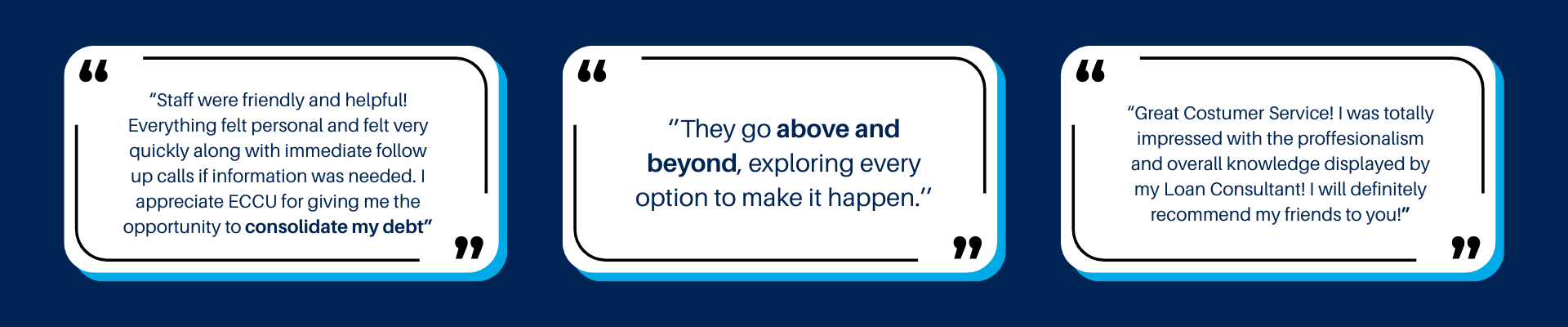

MEMBER STORIES

.png)

Debt Consolidation, Personal Loans, and Home Equity: Your Complete Guide on the ECCU Blog

Start your journey to financial freedom today!

Apply now and start the year with simpler, stress-free finances.

- APR = Annual Percentage Rate. 0% introductory APR valid for 12 months on balance transfers. Variable rates apply after the intro period ends. Terms and conditions apply.

.png)

.jpg)